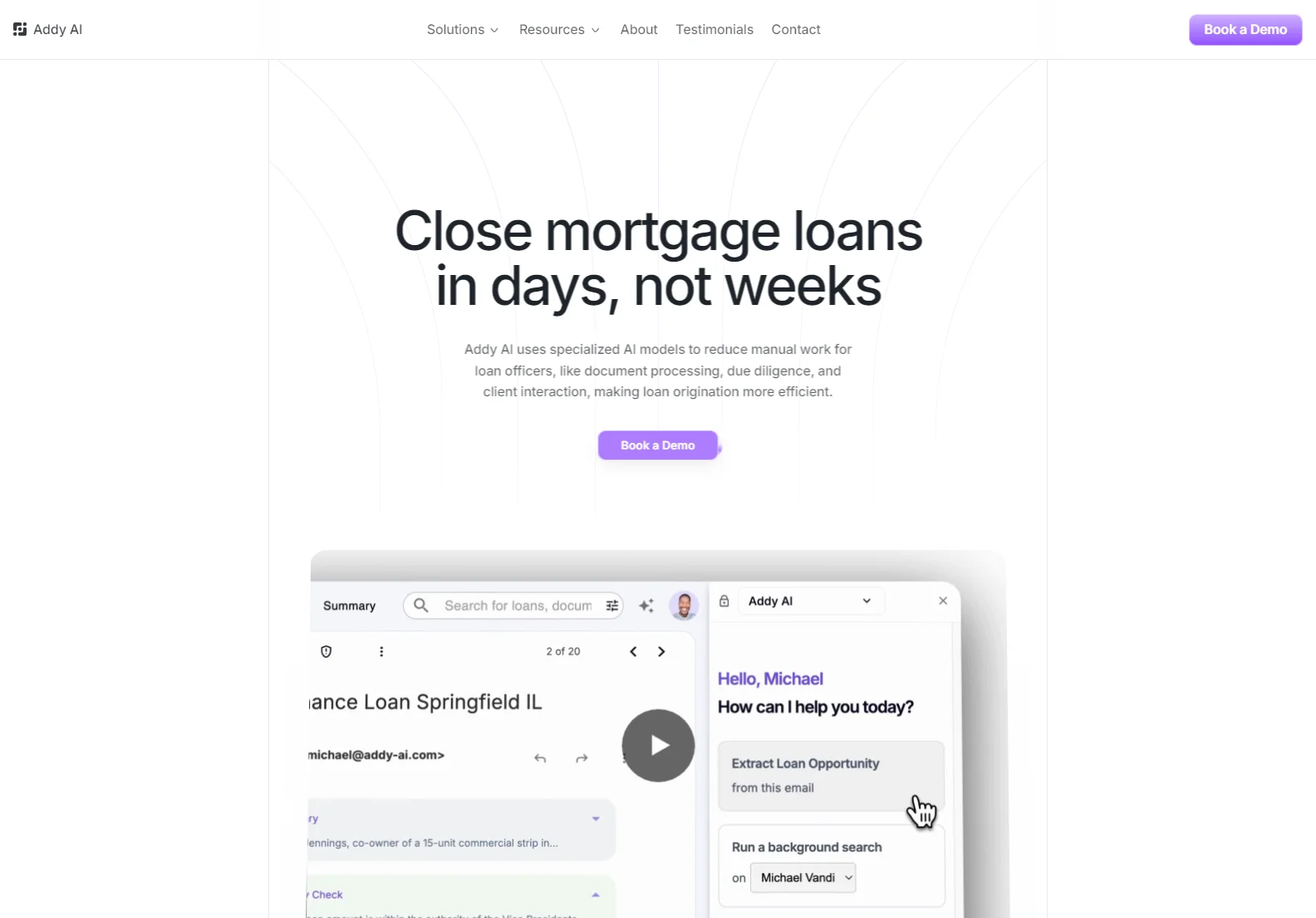

Addy AI: Revolutionizing Mortgage Lending with AI

Addy AI is transforming the mortgage lending industry by leveraging the power of artificial intelligence to streamline loan origination. This innovative platform automates time-consuming tasks, allowing loan officers to focus on what matters most: building relationships and closing deals. Addy AI's AI-powered solutions significantly reduce manual work, resulting in faster loan processing and increased efficiency.

Key Features of Addy AI

- Automated Document Processing: Addy AI uses cutting-edge computer vision to process documents like bank statements, W-2s, and 1099s, extracting key data in seconds. This eliminates the need for manual data entry and reduces the risk of human error.

- Instant Loan Assessments: The platform instantly assesses loans against your credit policy, identifying ineligible borrowers and suggesting steps to improve their eligibility. This speeds up the decision-making process and improves the overall borrower experience.

- AI-Powered Client Interaction: Addy AI enables you to train specialized AI models to handle client follow-ups, ensuring timely communication and enhancing client satisfaction. This frees up loan officers to focus on more complex tasks.

- Seamless CRM Integration: Addy AI integrates with your existing CRM, automatically syncing and updating loan data for a streamlined workflow. This reduces context switching and improves overall efficiency.

- Customizable AI Models: Train powerful AI models tailored to your specific needs and loan policies, ensuring the system adapts to your unique requirements.

Benefits of Using Addy AI

- Increased Efficiency: Automate tedious tasks, freeing up loan officers to focus on higher-value activities.

- Faster Loan Origination: Close loans in days, not weeks, improving turnaround times and client satisfaction.

- Reduced Manual Work: Minimize manual data entry and reduce the risk of human error.

- Improved Client Experience: Provide timely communication and personalized support.

- Enhanced Compliance: Ensure adherence to lending regulations and policies.

Addy AI vs. Traditional Mortgage Lending

Traditional mortgage lending processes often involve significant manual work, leading to delays and inefficiencies. Addy AI offers a significant advantage by automating many of these tasks, resulting in a much faster and more efficient process. The platform's AI-powered features provide a level of accuracy and speed that is simply not possible with manual processes.

For example, extracting key data from documents can take hours or even days using traditional methods. Addy AI can accomplish this in seconds, dramatically reducing processing time. Similarly, client follow-up, a time-consuming task for loan officers, is automated by Addy AI, freeing up their time for other important tasks.

Conclusion

Addy AI is a game-changer for mortgage lenders looking to improve efficiency, speed up loan origination, and enhance the client experience. By automating key tasks and providing valuable insights, Addy AI empowers lenders to stay ahead in a competitive market and close more loans faster.