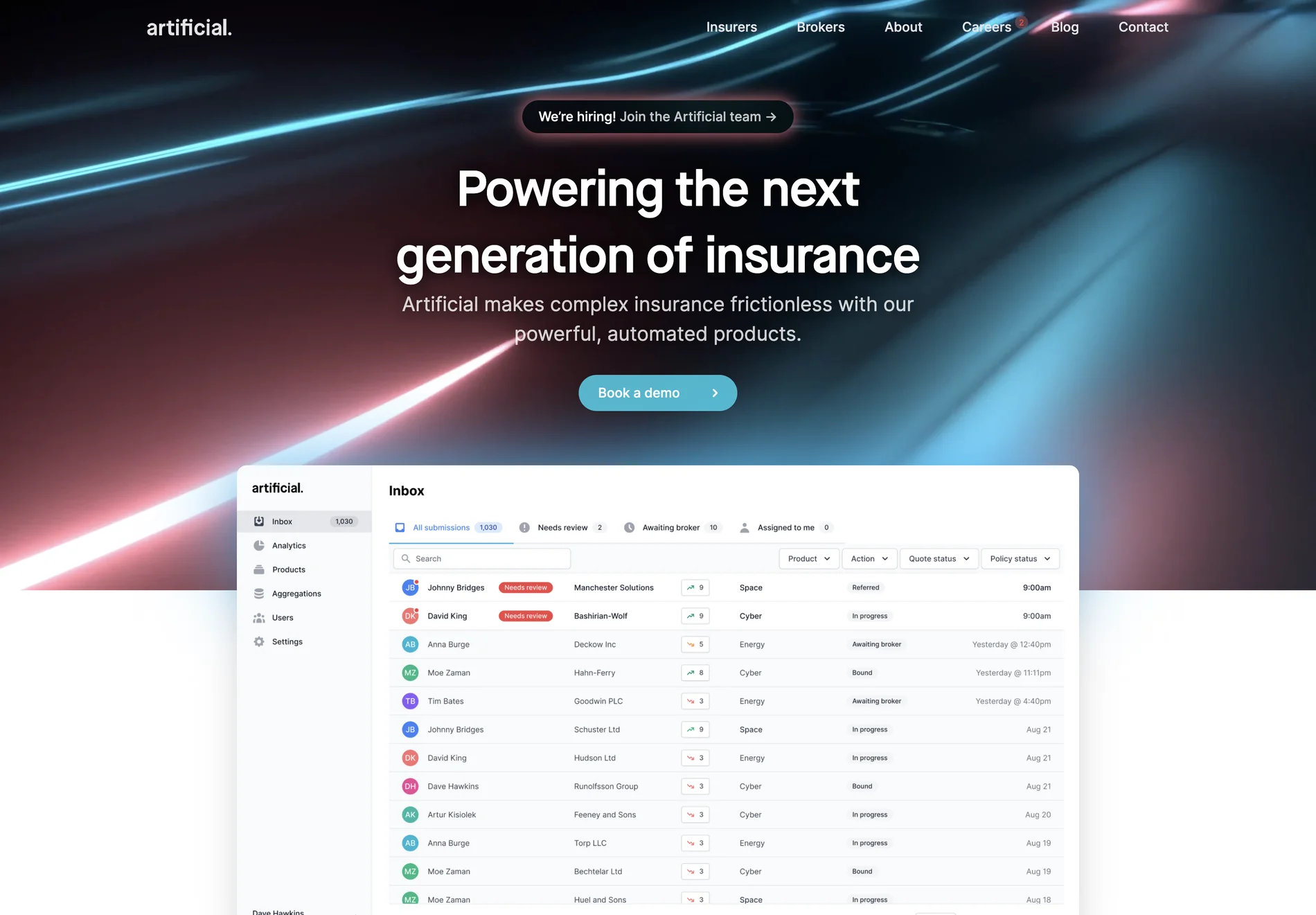

Write Better Risks, Faster with Artificial

Artificial is at the forefront of transforming the insurance industry through its advanced AI-driven solutions. By automating complex processes, Artificial helps insurers and brokers write better risks faster, improve performance, and reduce costs.

Key Features

- Underwriting Platform: Harness your data to write better risks, faster.

- Contract Builder: Simplify complex data entry with flexible, digital, and compliant contracts.

- Risk Selection Enhancement: Improve risk selection and reduce loss ratios with accurate data.

Use Cases

Artificial's solutions are trusted by some of the world's best insurance companies. For instance, Apollo Group Holdings has seen significant advancements in their operations using Artificial's technology.

Benefits

- Efficiency: Underwrite up to 8x faster, freeing up time for high-value tasks.

- Cost Reduction: Cut the cost of processing complex submissions by 90%.

- Performance Improvement: Enhance risk selection and reduce loss ratios.

Real-World Impact

Artificial's Contract Builder has been instrumental in driving efficiency for partners like BMS Group, transforming contract documentation production and meeting the demands of the digital era.

Conclusion

Artificial is not just a tool; it's a game-changer for the insurance industry. By leveraging AI, it empowers businesses to achieve maximum growth and efficiency, setting a new standard for insurance operations.