Introduction to FinFloh

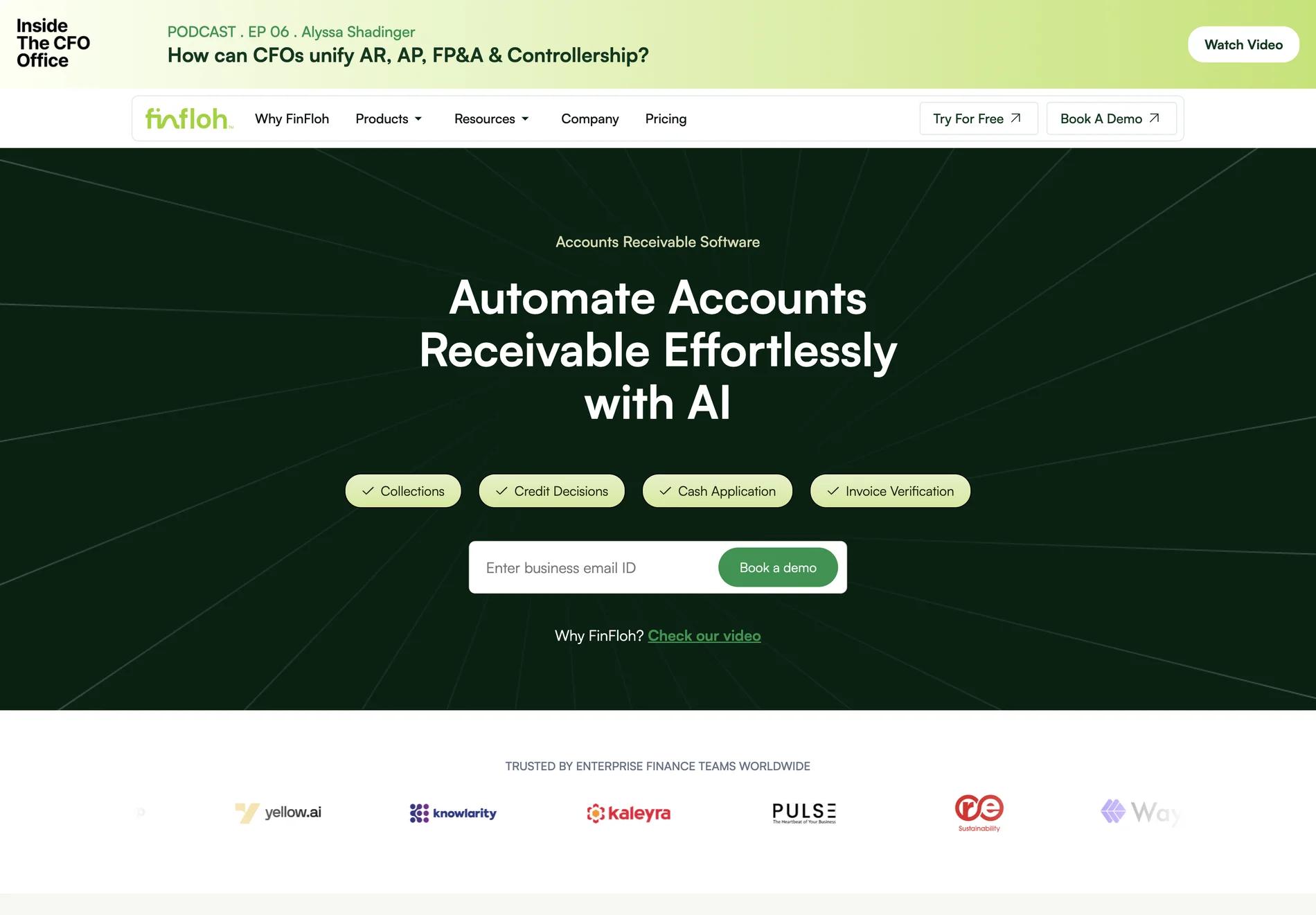

FinFloh is an innovative accounts receivable automation software designed to streamline and enhance the invoice-to-cash process for B2B finance teams. By leveraging AI and machine learning, FinFloh aims to unify various aspects of accounts receivable management, including credit decisioning, collections, disputes, and cash application.

Key Features of FinFloh

- AI in Credit Decisioning: FinFloh utilizes machine learning for credit-risk scoring, using market and historical data to make informed decisions about credit, contract, and pricing terms within CRMs like Salesforce.

- AI in Collections: The platform offers an AI-powered collectors’ worklist designed for maximum collections efficiency, with workflow assignment based on risk, amount, and priority.

- AI in Disputes: Predictive AI is used for advanced dispute intelligence and diagnosis, with automated dispute resolution capabilities.

- AI in Cash Application: FinFloh features AI-driven remittance aggregation and capture, with exception handling, capturing short payments, and Promise-to-Pay.

Benefits of Using FinFloh

The integration of FinFloh into a company’s financial operations can lead to significant benefits, including a reduction in Days Sales Outstanding (DSO), man-hour savings, and a decrease in high-aging balances. By automating and optimizing the accounts receivable process, businesses can experience improved cash flow and reduced bad debt.

How FinFloh Works

FinFloh is designed to be user-friendly and integrates seamlessly with existing ERP/CRM systems, allowing for the auto-fetching of invoices and the resolution of billing ID and cancellation issues. The platform also enables centralized seller-buyer communication, facilitating the resolution of disputes and improving overall collections efficiency.

Conclusion

FinFloh represents a significant advancement in accounts receivable management, offering a comprehensive and automated solution for B2B finance teams. By harnessing the power of AI and machine learning, FinFloh helps businesses to streamline their financial operations, reduce costs, and enhance their overall financial health.