Planck: Revolutionizing Commercial Insurance with GenAI

Overview

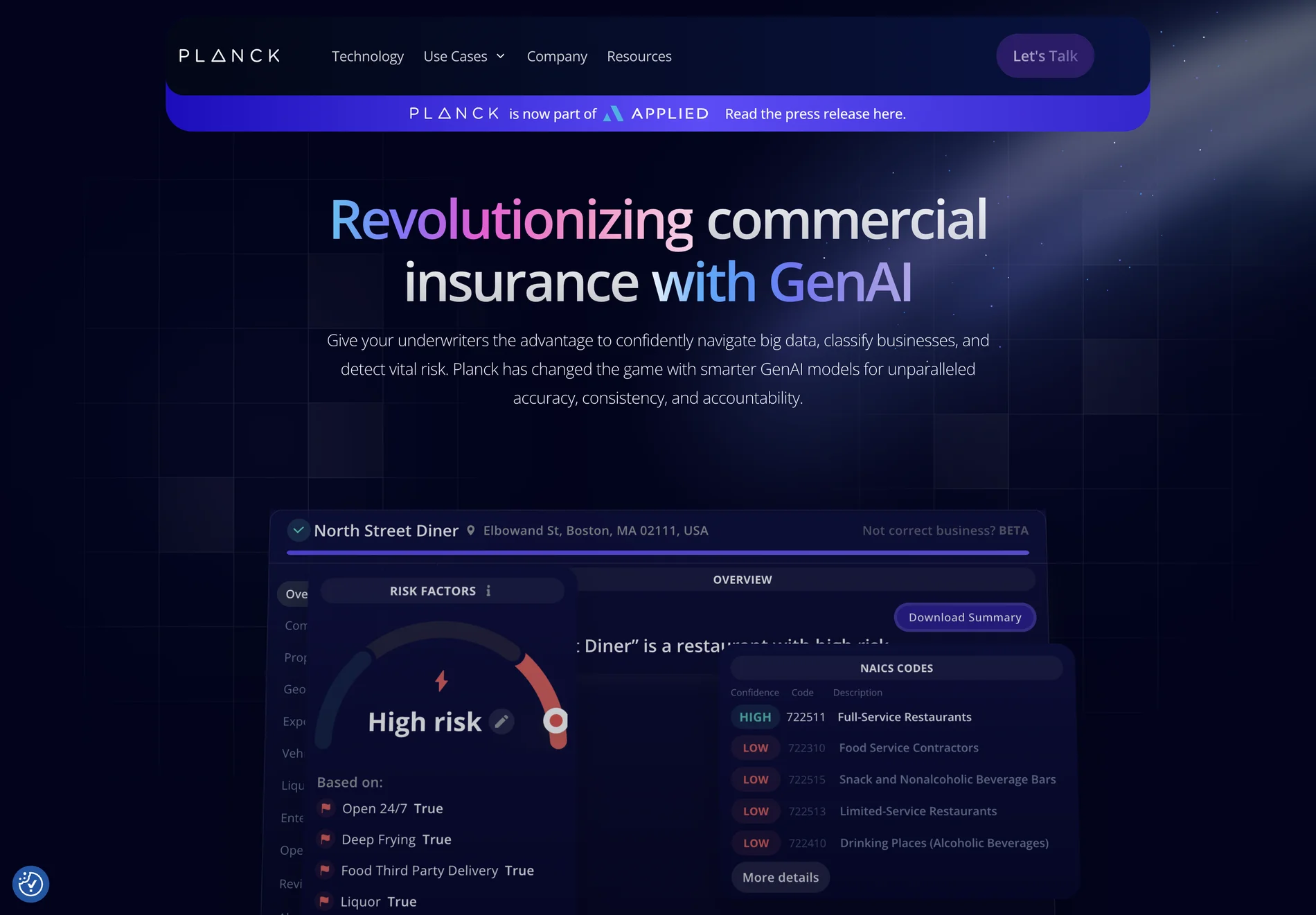

Planck is at the forefront of transforming commercial insurance underwriting through its advanced Generative AI (GenAI) models. This platform empowers underwriters to confidently navigate big data, classify businesses, and detect vital risks with unparalleled accuracy, consistency, and accountability.

Key Features

- GenAI Models: Planck's smarter GenAI models offer a new level of precision in risk assessment and underwriting.

- Data Insights: Enriched with unique context, Planck combines several neural networks to provide deeper understanding of patterns, trends, and key risks.

- Customizable Risk Definitions: Tailor insights to align with your organization's specific risk definitions.

Use Cases

Planck is particularly effective in the following scenarios:

- High-Risk Business Classification: Accurately identifies and assesses high-risk businesses, such as restaurants and bars, based on detailed data analysis.

- Underwriting Efficiency: Enhances the underwriting process from submission to renewal, uncovering correlations and new risks that manual analysis might miss.

- Predictive Insights: Keeps you ahead of emerging market trends and evolving risks with predictive analytics.

Pricing

Planck offers flexible pricing models to meet the needs of various organizations, ensuring that businesses of all sizes can benefit from its advanced AI solutions.

Comparisons

Compared to traditional underwriting methods, Planck stands out due to its:

- Accuracy: Higher precision in risk prediction and classification.

- Efficiency: Streamlined processes that save time and resources.

- Transparency: Evidence-backed transparency and confidence scoring.

Advanced Tips

- Integration: Start with Planck PLUS Data for better underwriting data and classifications.

- Process Optimization: Utilize Planck PLUS Risk Workbench for improved underwriting process and efficiency.

- Enterprise Solutions: Opt for Planck Enterprise for comprehensive enterprise-level solutions.

Planck is not just an AI tool; it's a revolution in commercial insurance underwriting, offering a future-proof solution for the industry.