WorkFusion: AI for AML Risk Mitigation

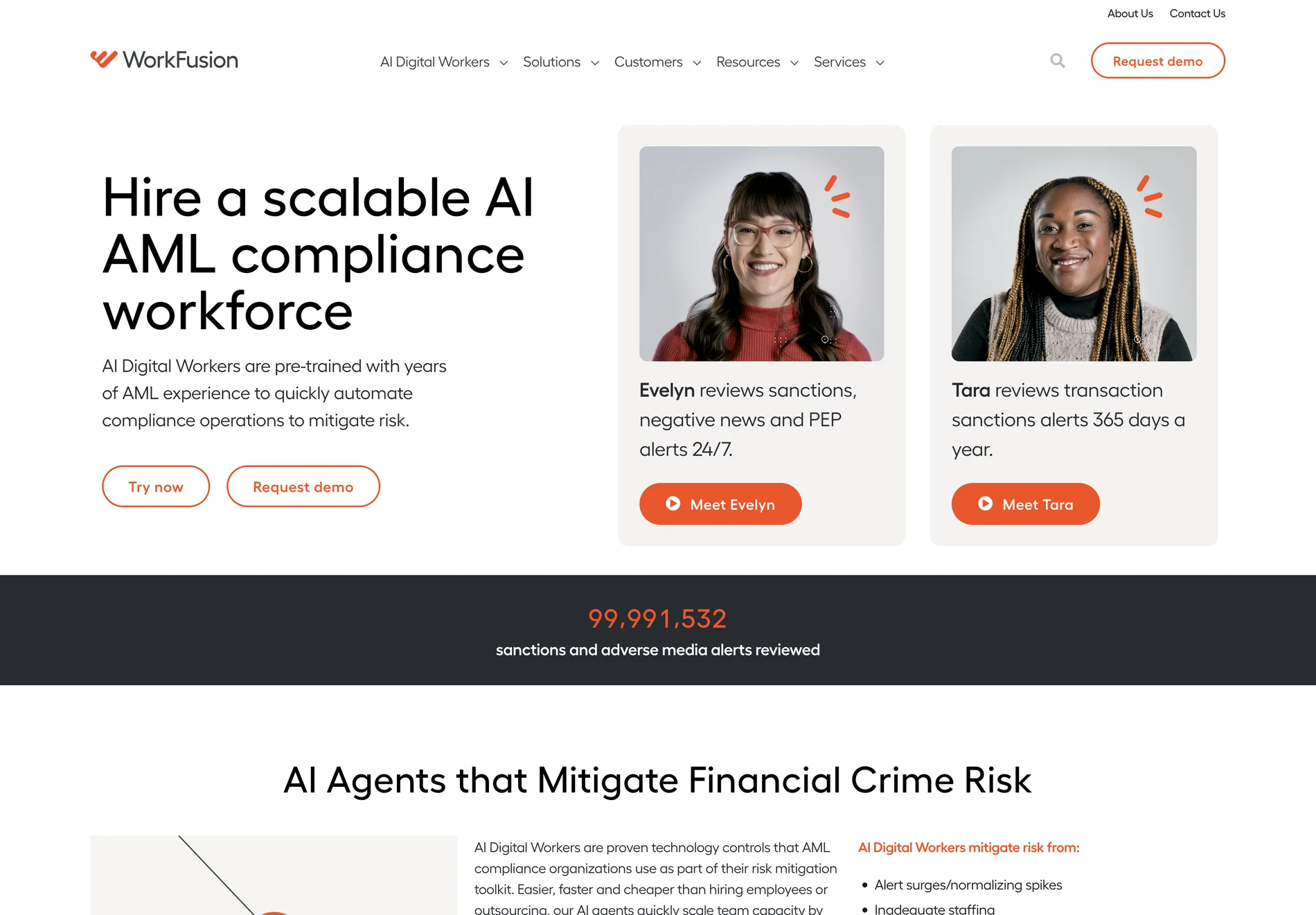

WorkFusion offers a cutting-edge AI-driven solution designed to automate Anti-Money Laundering (AML) compliance operations, thereby mitigating financial crime risk effectively. Their AI Digital Workers are pre-trained with extensive AML experience, enabling them to swiftly automate compliance tasks and reduce risk.

Key Features

- Automated Compliance Operations: WorkFusion's AI Digital Workers handle tasks such as sanctions screening, adverse media monitoring, and transaction monitoring investigations.

- Scalability: These AI agents can scale team capacity by fulfilling complete level 1 AML analyst roles, making them easier, faster, and cheaper than traditional hiring or outsourcing methods.

- Enhanced Efficiency: By automating tedious work, WorkFusion allows human analysts to focus on higher-risk areas, improving overall compliance effectiveness.

Use Cases

- Sanctions Screening: Automatically scale up capabilities for sanctions screening and name/PEP screening to adhere to BSA/OFAC requirements.

- Adverse Media Monitoring: Streamline investigations of negative news to reduce the risk of regulatory penalties.

- Transaction Screening: Adjudicate false-positive sanctions alerts in near real-time, ensuring transactions remain risk-free.

Benefits

- Risk Mitigation: AI Digital Workers help in mitigating risks from alert surges, inadequate staffing, and missed escalations.

- Cost Reduction: By reducing manual effort and L2 escalations, WorkFusion offers a cost-effective solution for AML compliance.

- Enhanced Compliance: Detailed narratives and complete audit trails improve compliance with regulatory standards.

Real-World Impact

WorkFusion serves four of the top five US banks and leading financial institutions worldwide, demonstrating its effectiveness in real-world scenarios. Their solutions have been proven to enhance efficiency, improve compliance, and reduce the global cost of financial crime compliance.

Conclusion

WorkFusion's AI Digital Workers are a game-changer in the realm of AML compliance, offering a scalable, efficient, and cost-effective solution to mitigate financial crime risk. By leveraging advanced AI technology, WorkFusion ensures that organizations can maintain robust compliance standards while optimizing their resources.